In this article, you will learn how AP software can assist in recording intercompany transactions, as well as adding visibility across multiple accounts.

When processing supplier invoices, it is important to do intercompany and inter-entity postings right at the beginning, so it is easier to reconcile data when it gets to your accounting or ERP system.

What is an intercompany transaction?

An intercompany transaction is a transaction that occurs between different legal units within the same entity. In other words, when an organisation owns more than one company, branch or subsidiary – it can perform intercompany transactions.

For example, transfer funds from one company to another, pay for or split bills with another company. It can be a simple bill split or part of the complex procurement process. For example, a large organisation with multiple companies can use its buying power to negotiate a deal to make an order. Then it will split the bill between its subsidiaries.

Intercompany transactions are a smart way to improve the flow of finances and assets between different entities.

However, there is always a hassle in recording intercompany transactions. An accountant will have to record an inter-company transaction first, create manual journals for all companies and credit/debit all the right accounts. So, in the end, there is less stress in reconciling bank accounts.

If your business performs intercompany transactions, it is important that your AP software support intercompany postings between companies.

In Ocerra AP software we can streamline intercompany transactions through intercompany postings functionality. In this article, we will be using Xero as an example to demonstrate how intercompany transactions can be automated using Ocerra AP software.

Example scenario

Let’s assume that we have Company “A” and Company “B” and we would like to split the bill between these two companies. Company “A” is Headquarters and will be the one responsible for the bill payment and initial recording of the intercompany transaction.

Intercompany accounting in Xero

Before recording intercompany transactions in Xero (if you haven’t done it yet), you will need to create GL codes for each company:

In Company “A”, the headquarters: 641 for Due from as Current Asset:

For Company “B”: 841 for Due to HQ as Current Liability:

Ocerra AP automation software

Now let’s open a bill in Ocerra in Company “A” that we would like to split with Company “B” 50/50:

We have added a new line and adjusted Net Amount for both companies.

Now, when we switch to company B in Ocerra – we will see a new bill record:

This record shows that we owe $225 to company A, the Headquarters.

Xero

Now we are going to export our original bill from Ocerra company A to Xero, make payment and see our manual journal record:

In details:

Here’s the bill that we have just exported from Ocerra to Xero, it has two lines (we made a payment in the video above, so it shows as paid):

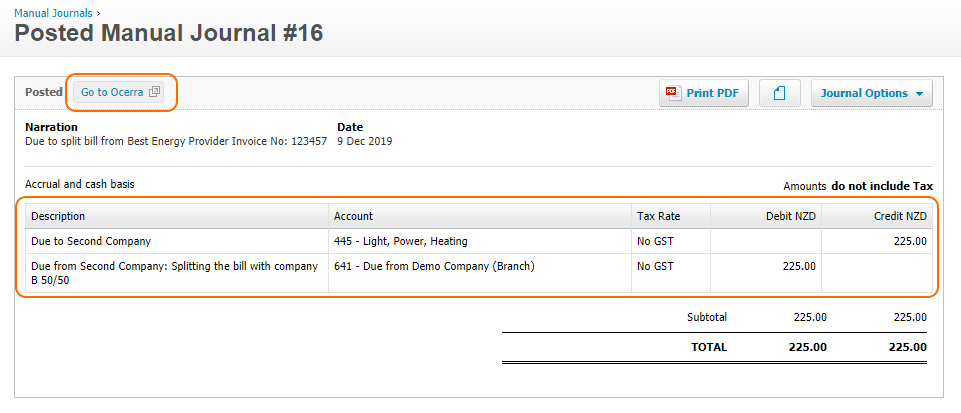

Here’s the manual journal record that Ocerra created in Xero when we exported the bill to company A:

In company B, we will also see a manual journal record created by Ocerra:

Video:

Manual journal record in company B:

Company B will need just o reconcile “Due to HQ” account.

Balance sheets

This all will reflect in Balance Sheets accordingly.

In company A – Current Asset - All Due from:

In company B – Current Liability - All Due to HQ:

If you have any questions about intercompany postings in Ocerra, please let us know, we’ll be happy to help.

Other helpful articles: How does Occerra AP software complement Xero?

Comments