Introducing Accounts Payable Report dashboards for data-driven CFOs

- Irina Kavchik

- Mar 12, 2020

- 4 min read

With new technology available today, your competitor’s business moves faster than ever before. Therefore, a successful CFO should provide not only an accurate report on the financial position of the company but also – on a timely basis with great detail and insight. They will also continually educate themselves and search for the best tools to enhance the data-driven decision-making process.

Accounts Payable department is an excellent source of critical financial information, but often it is undervalued and under pressure. Manual invoice processing and data entry are hindering the opportunity of prompt data insights. There is a solution.

AP automation solution

A right AP solution includes invoice scanning and data capture software, automated approval process, export and reporting functionalities at its minimum.

Automated invoice data entry software saves an enormous amount of time, but it can also unlock valuable data insights when bundled together into one AP solution.

Accounts Payable Report dashboard per company

Ocerra is an AP automation solution; along with invoice OCR software, we developed a range of useful features for data-driven managers.

Our accounts payable report dashboard offers live invoice processing insights and KPIs. This data is based on the incoming invoices and its instant data capture.

Here’s our first version of the accounts payable report dashboard per company basis:

The top insights bar is giving an overview of all your invoices at a specific time frame:

Invoices waiting for approval

Total number of invoices

Approved invoices

Amount due

Invoices by month report

Invoices by month report are giving you the number of Purchase Order (PO) invoices versus non-PO invoices.

The accounts Payable aging report

One of the challenges in the Accounts Payable Process is paying bills on time. Consequences of late payments may include not getting the “parts”, the late payment penalties or missed early payment discounts. Ultimately, it is negatively affecting your relationships with suppliers. Everyone wants to be paid on time to sustain a healthy and successful business.

If you have hundreds or thousands of invoices every week or month, it is essential to sort out invoices by the due date. This way, you can ensure that invoices are paid on time, not earlier or later. If you are paying your suppliers way in advance than the terms require, you are managing your cash flow poorly. If you are paying too late, you are risking all the above consequences. Either way, you need to pay just on time.

The problem is that it often takes time to sort out invoices, make sure they are legitimate, matched with the purchase order, approved and coded into the system. Even if you are very diligent and hard-working, it doesn’t guarantee on-time payment.

AP automation and invoice data capture software significantly reduce the time required to process supplier invoices. Because it automatically captures PDF invoices from your email and extracts “due dates” and “payment terms” from the invoices as they arrive. So, you can track all your invoices that are due in 7-days, 14-20 days, 20-30 days and 30+ days.

Approval Notes

It is handy to see all the recent invoice approval notes. We made it for the last ten invoices. Another KPI to keep everything under control and on track.

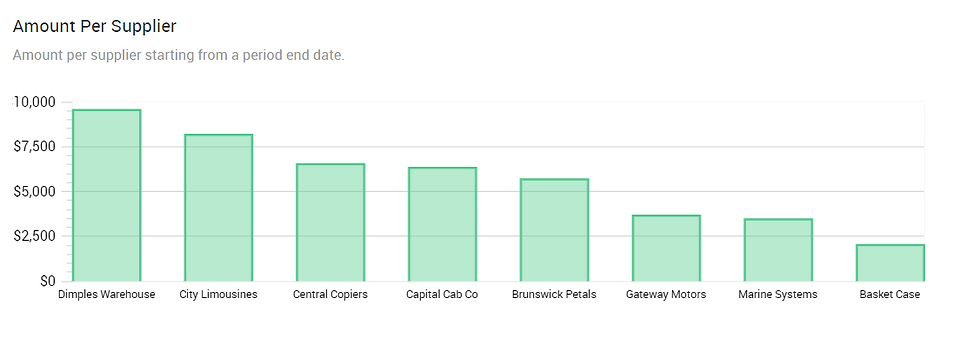

Amount per supplier

See top 5 suppliers that you are currently working with. Negotiate better deals with them.

Custom Power BI reports

If you would like to create your custom Accounts Payable Report dashboard in Ocerra, you can use power functionality.

Multi-company accounts payable dashboard report (…is coming soon!)

In Ocerra, you can perform invoice processing for multiple companies all in one place. There is no need to log in or log out to access invoice data of each company you own.

Each company has its unique accounts payable report dashboard that you can drill into (see above).

For a multi-entity business, we offer a consolidated accounts payable report:

A summary dashboard provides real-time information across multiple companies.

Like in the per company report, we can see quick data for all the companies:

Total Number of Invoices

Invoice Waiting for Approval

Approved Invoices

Due amount

By default, it shows ALL the data by period end date (e.g. 20th of each month).

An advanced Accounts Payable Aging Report

While it is not a standard Accounts Payable Aging report that shows information “per supplier”, is has a lot more value for a multi-company organization. Our report shows information “per company” for the cross-company invoice processing analyses.

The aging report is a critical tool to forecast cash outflow and spot any fraudulent activity. It shows all the outstanding invoices split into payment terms.

We are also offering a Power BI functionality that allows creating a custom accounts payable report. In this article, we talk about how to create your Accounts Payable Aging Report using Microsoft Power BI.

Due amount per company per period

This donut chart offers a quick view of all the companies with outstanding balances and requires your immediate attention. You can drill down by clicking into each wedge to see outstanding invoices for this company.

Invoice status across companies

The number of invoices per status per selecting period report gives you an overall performance overview.

This report helps you to identify where the invoice in the workflow and if everything is running smoothly. For example, you might have over 70 invoices sitting in the rejected status. You need to examine it further.

Amount per supplier across companies

Same as for the single view accounts payable report dashboard. This one shows the top 10 suppliers per period including all the companies in the organisation.

To conclude:

Invoice data capture software on its own is a great tool, but it is not enough for a data-driven CFOs. There are multiple challenges associated with invoice processing, but the most critical one is proving timely data insights. With AP automation and invoice OCR software like Ocerra, you get the entire AP process under control.

Let us know what you think

A summary dashboard is still in progress, and we are looking for any feedback to make it better.

If you have any specific Accounts Payable report requirements or use cases, let us know in the comments below.

Comments